Homes are flying from the shelves in 2010, therefore it is more important than ever to be certain you get a credible home loan originator in order to romantic the deal.

To keep track the new easily growing housing marketplace, the amount of those who acquired the home loan originator permits almost twofold during the last 10 years, with regards to the Conference regarding Condition Bank Executives (CSBS).

Luckily for us there are a ton of financing originators contending for your business. Between lender team and you can private designers, good homebuyer you certainly will pick a virtually limitless set of mortgage mortgage originators (MLOs) to work well with. Exactly how do you like?

To shop for a house is not a decision you need to take carefully, says Molly Ellis, degree and outreach manager within Ca Homes Money Department. Ellis cautions individuals that this is the biggest and most difficult economic exchange of the life. Put another way, you should favor their MLO intelligently.

Going for a well-qualified home mortgage manager (MLO) can lead to a more smooth home loan app procedure and you will a best mortgage bargain. However, a bad MLO you are going to leave you upset, produce to your an unmanageable mortgage, if you don’t encourage one commit ripoff.

What is actually a mortgage loan Originator?

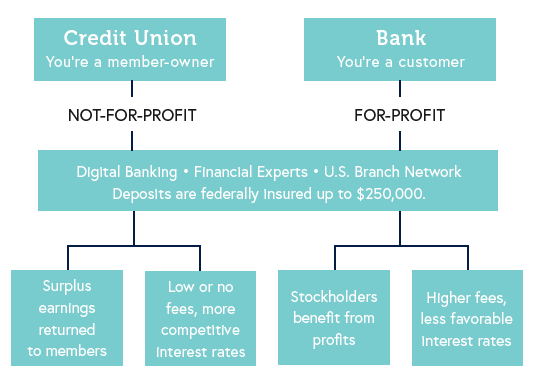

A mortgage loan inventor (MLO) is actually a person who deals with a good homebuyer to assist them safer home financing. MLOs shall be possibly independent builders or professionals of creditors, for example finance companies and you may borrowing from the bank unions, and perhaps they are possibly labeled informally by most other titles instance mortgage officials or loan representatives.

An enthusiastic MLO’s first character will be to gather your own associated pointers, help you with the loan application, and potentially discuss certain regards to your financial, in return for settlement.

However, a great MLO will perform even more, states Florida-depending real estate loan originator Jose Diaz. Diaz states its his employment to set up website subscribers towards the difficult processes these include planning to feel, very he can make a time to spell it out that which you up-front side, on loan application into closure day.

Expert Tip

A mortgage loan maker commonly assist you from the homebuying processes, make it easier to navigate mortgage selection and educate you on just how to loans Lillian AL be eligible for the best home loan.

What do Home loan Originators Create?

Out-of application to help you closing, a keen MLO are going to be a close-lingering provider and you may part off get in touch with in homebuying techniques. Actually, Diaz states you may be when you look at the communication as frequently while the shortly after twenty four hours at that moment. This is what this new MLO does:

step 1. Very first contact

When you initially contact a keen MLO, you need to anticipate to receive specific suggestions for ideas on how to ready yourself to suit your application for the loan, for instance the records you will need to collect.

Which 1st contact is additionally a way to learn about the fresh new MLOs certificates, including the understanding of people particular basic-date homebuyer apps you have in mind or assets systems you want to get. Don’t be afraid to ask questions, Ellis states. In the event the [the MLO is actually] agitated along with you as you happen to be inquiring a concern, that will be a red-flag.

2. Prequalification meeting

During this first in-individual meeting, the newest MLO commonly remark your posts, work with their credit and you may take you step-by-step through your own money choices.

If you find yourself in a position, the MLO will also help your done and complete very first programs to have financial prequalification. Ideally, you are able to walk away on ending up in a loan bring you to you can make use of to find homes, however the MLO may give customized suggestions about how to improve your possibility of loan acceptance, plus steps you can take to improve your credit, states Diaz.